Table of Contents

- Introduction

- Key Takeaways

- Editor’s Choice

- Stock Trading App Revenue

- Stock trading revenues by app 2023 ($mm)

- User Demographics and Trends

- Top Apps and Revenue Drivers

- Regional Insights

- 10 Best Investing Apps

- Emerging Trends in Investment Apps

- Top Use Cases for Investment Apps

- Major Challenges

- Attractive Opportunities

- Conclusion

Introduction

Investment Apps Industry are mobile or web-based applications that allow individuals to manage their portfolios, trade stocks, bonds, and other securities, and access financial information and analysis with ease. These platforms cater to investors ranging from beginners to experts, offering tools and features such as automated investing, real-time market data, educational resources, and sometimes, personalized financial advice. The convenience of managing investments from anywhere at any time has significantly contributed to the popularity of these apps.

According to Market.us, the global investment apps market is showing remarkable growth and is poised to reach an impressive value of USD 254.9 billion by 2033, rising significantly from USD 44.4 billion in 2023. This reflects a robust compound annual growth rate (CAGR) of 19.1% during the forecast period of 2024 to 2033. In 2023, North America led the market, securing a dominant share of over 34% and generating USD 14.96 billion in revenue. The growing popularity of digital investment platforms, user-friendly app interfaces, and increasing accessibility to global markets have been key factors driving this expansion.

Several factors drive the expansion of the investment apps market. The democratization of financial information and the ease of access to market data have empowered a broader audience to engage in investing. The integration of advanced technologies such as artificial intelligence and blockchain enhances the functionality of these apps, providing personalized advice and secure transactions. Furthermore, the shift towards mobile-first solutions reflects the growing trend of on-the-go trading and investing, making financial markets more accessible to the general public than ever before.

![]()

The demand for investment apps is primarily driven by the retail segment, which has significantly benefited from the ability to access financial markets directly from smartphones and other devices. This trend is particularly prominent in North America, where the market is characterized by high smartphone penetration and a tech-savvy consumer base. The region’s established financial infrastructure and innovative ecosystem contribute to its dominance in the market.

Technological innovations continue to shape the investment apps industry. The adoption of machine learning algorithms allows apps to offer customized investment guidance and portfolio management with minimal human intervention. Blockchain technology is being increasingly utilized to enhance the security of transactions and improve transparency in operations. These advancements not only enhance user experience but also improve the reliability and efficiency of the services provided by investment apps.

The investment apps market is ripe with opportunities, particularly in terms of product development and geographic expansion. Companies in the sector are focusing on strategic partnerships and acquisitions to broaden their service offerings and reach new customer segments. There is also significant potential in catering to the evolving demands of a younger, more diverse investor base who favor platforms that offer both robust functionality and a high degree of usability.

Key Takeaways

- The Global Investment Apps Market is set to experience remarkable growth, with its size projected to climb from USD 44.4 billion in 2023 to a staggering USD 254.9 billion by 2033. This reflects a strong CAGR of 19.1% over the forecast period.

- North America took the lead in 2023, commanding a 34% market share and generating approximately USD 14.96 billion in revenue.

- The derivatives segment emerged as a standout performer, contributing over 27% of the market share in 2023, making it a key driver of growth.

- Mobile-based platforms dominated the landscape, capturing more than 60% of the total market share in 2023, reflecting a shift towards on-the-go investing.

- Among operating systems, Android held a strong position, owning 43% of the market share, showcasing its popularity among users.

- The retail segment led the market with a commanding 71% share in 2023, underlining the increasing involvement of individual investors in leveraging investment apps.

Editor’s Choice

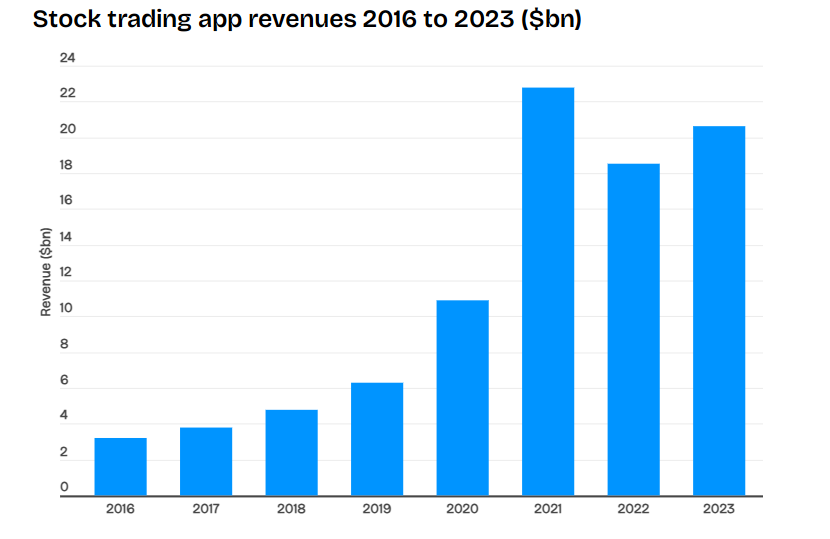

- $20.6 billion in revenue – Stock trading apps generated $20.6 billion in 2023, showing an 11.3% increase compared to last year. This growth reflects the rising interest in digital trading.

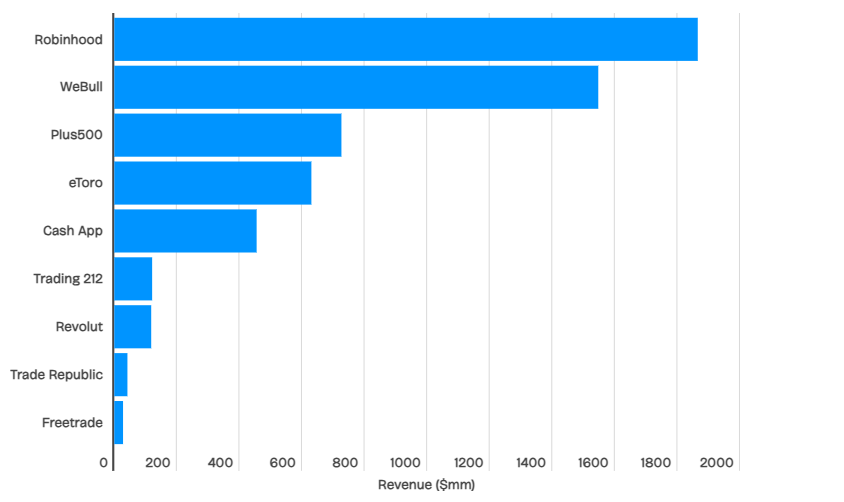

- Robinhood dominates – Robinhood emerged as the leader among zero-commission trading platforms, earning $1.8 billion in revenue, the highest in the category.

- 117 million users worldwide – Stock trading apps were used by 117 million people in 2023, slightly up from last year but still below the record highs of 2021.

- Robinhood’s valuation soars – Valued at $16.9 billion, Robinhood more than doubled the worth of its nearest competitor, WeBull.

- Searches up 115% YOY – Interest in investing apps is surging, with search terms like “penny stock trading app” and “investment apps” seeing a 115% year-over-year increase.

- First-ever stock exchange – The Amsterdam Stock Exchange, established in 1602, was the world’s first organized stock exchange.

- Dotcom crash wiped out half the S&P 500 – During the dotcom bubble burst, the S&P 500 lost 50% of its value, a downturn that spanned two years and eight months.

- Fractions phased out in 2000 – Until 2000, stock prices were quoted in fractions instead of decimals, making trading less straightforward than it is today.

- Top three companies by market cap – As of August 2, 2023, Apple, Microsoft, and Alphabet lead the global stock market with the highest market capitalizations.

- Recovery from market dips – A 5%-10% market decline usually recovers within a month, providing a quick bounce for cautious investors.

- 10% of U.S. households invest globally – Only 10% of American households hold international equity, showing a preference for domestic markets.

- 19 global giants – Nineteen stock exchanges worldwide boast a market capitalization of over $1 trillion, cementing their importance in global finance.

- Five companies above $1 trillion market cap – Apple, Microsoft, Saudi Aramco, Amazon, and Alphabet are the only companies to have crossed the $1 trillion valuation.

- Automation drives 80% of the market – Over 80% of stock market activity is powered by automation, highlighting the pivotal role of technology in modern trading

Stock Trading App Revenue

Stock trading revenues by app 2023 ($mm)

Source- businessofapps.com

| Stock Trading Application | Annual Revenue |

| DotBig Platform | Less than $5 million |

| Thinkorswim | $27.7 million |

| TradingView | $144.6 million |

| Kite by Zerodha | $600 million |

| eToro | $617.9 million |

| Binance Broker | $961 million |

| E*Trade Web | $2.4 billion |

| Coinbase Prime | $5.9 billion |

| Active Trader Pro | $16.9 billion |

* The above information is sourced from ZoomInfo and Growjo.

User Demographics and Trends

Retail investors are taking center stage, capturing 71% of the market share in 2023. This reflects a notable rise in individual investors embracing stock trading apps. Mobile platforms remain the top choice, holding over 60% of the market, thanks to their convenience and user-friendly design. Meanwhile, web-based platforms are steadily gaining popularity among users managing larger or more complex portfolios.

Top Apps and Revenue Drivers

Robinhood secured its spot as the global leader in stock trading apps, raking in $1.8 billion in revenue for 2023. Close behind was WeBull, as more users turned to digital platforms for trading. Despite a dip from the 137 million users in 2021, the market still saw an impressive 117 million active users in 2023. Searches for investing apps have skyrocketed by 115% year-over-year, showing growing curiosity and interest among consumers to engage in trading.

Regional Insights

In 2023, the North American region maintained a dominant position within the investment apps market, capturing more than a 34% share. This translates to an impressive revenue of approximately USD 14.96 billion. The substantial market share held by North America can be attributed to several factors including a well-established financial infrastructure and a strong technological ecosystem that supports the development and proliferation of digital financial services. The presence of major tech hubs such as Silicon Valley further fuels innovation and adoption of new financial technologies in the region.

The investment landscape in North America is significantly shaped by the widespread use of smartphones and the high penetration of internet connectivity, which facilitate easy access to financial markets through investment apps. This region’s market dominance is also bolstered by the proactive adoption of advanced technologies such as AI and blockchain by North American firms, enhancing the functionality and security of these platforms.

![]()

10 Best Investing Apps

- Robinhood: Best for active traders due to its user-friendly interface and commission-free trading of stocks, options, ETFs, and cryptocurrencies.

- Fidelity: Recommended for low fees and a variety of investment options, making it ideal for both new and experienced investors. Fidelity is especially noted for its retirement services.

- Acorns: Great for micro-investing, as it allows users to invest spare change automatically. It’s tailored for busy investors who prefer a hands-off approach to growing their investments.

- E*TRADE: Offers a robust platform for both beginners and more advanced traders, with a wealth of tools and resources to assist with investing. It’s known for its no-fee structure on basic investments and live market data access.

- Charles Schwab: Known for its exceptional user experience and wide range of investment choices, making it suitable for both new and seasoned investors. It offers advanced research tools and real-time data.

- SoFi Active Investing: Offers no-fee stock and ETF trading and is noted for its attractive platform for more experienced traders. However, it lacks options for bonds and mutual funds.

- Betterment: Best for passive investing, offering automated portfolios with features like tax-loss harvesting and rebalancing. It’s a solid choice for those looking for a goal-based investing approach.

- Wealthfront: Known as the best automated investing app due to its low-cost, automated investment portfolios. It offers a high degree of customization and is geared towards tech-savvy investors looking for a digital-only experience.

- Stash: Suitable for those looking for an all-in-one financial app, it offers the ability to invest in a wide range of ETFs and stocks and is particularly appealing to families teaching their children about investing.

- Fundrise: Best for real estate investors interested in getting started with a small amount. It makes real estate investing accessible through REITs and has different portfolio tiers based on investment goals.

Emerging Trends in Investment Apps

- Artificial Intelligence Integration: The incorporation of AI into investment apps is enhancing their capabilities significantly. By 2023, the AI industry is expected to grow by 12%, largely influencing sectors such as investment apps by automating advice and portfolio management.

- ESG Investment Growth: There is a rising trend in investments that consider environmental, social, and governance (ESG) factors. Investors are increasingly drawn to these options, seeing them as ways to align financial goals with personal values.

- Robo-Advisors’ Popularity: The adoption of robo-advisors is increasing. These automated platforms offer personalized investment management with minimal human intervention, appealing to a tech-savvy demographic that values efficient, data-driven financial decisions.

- Expansion of Digital Payments: Investment apps are integrating more seamless payment technologies, reflecting a broader trend in financial services where ease and speed of transactions are prioritized. The adoption of systems like FedNow is illustrative of this shift towards instant digital payments.

- Cloud Technology Adoption: Investment apps are leveraging cloud computing to enhance their infrastructure. This not only aids in handling large volumes of data but also improves the scalability and performance of financial services.

Top Use Cases for Investment Apps

- Daily Financial Management: Investment apps are increasingly used for daily financial tasks, from budgeting to monitoring investments, reflecting a shift towards continuous, real-time financial oversight.

- Wealth Management: With a growing number of users preferring to have their funds managed by professionals, investment apps are incorporating services like Registered Investment Advisors (RIAs) to provide tailored financial advice and management.

- Retirement Planning: Apps are making it easier for users, especially millennials, to plan for retirement by providing tools that help in setting long-term financial goals and tracking progress towards them.

- Alternative Credit Scoring: To increase financial inclusion, some investment apps are using alternative data for credit scoring, thus helping those without traditional credit histories gain access to financial products.

- Engagement Through Loyalty Programs: To retain users and increase engagement, investment apps are introducing loyalty programs that reward users for frequent interactions, making financial management both beneficial and rewarding.

Major Challenges

- Regulatory Compliance and Oversight: Investment apps must navigate complex regulatory environments that vary by country and region. Adhering to these regulations while also innovating can be challenging, as non-compliance can lead to significant penalties and damage to reputation.

- Cybersecurity Threats: As investment apps handle sensitive financial data, they are prime targets for cyber-attacks. Ensuring robust security measures are in place to protect user data and prevent breaches is a constant challenge.

- Market Volatility: Investment apps need to manage the impact of market volatility on user investments. Sudden market changes can lead to panic selling or buying, putting pressure on the platforms to maintain stability and offer timely, accurate information.

- Technological Infrastructure: Maintaining and upgrading technological infrastructure to ensure seamless user experiences is critical. As user bases grow, scaling infrastructure without compromising performance or security requires significant investment and expertise.

- User Trust and Retention: Building and maintaining user trust is crucial, especially given the financial nature of the services. Investment apps must continually prove their reliability, transparency, and value to retain users, particularly in a competitive market where users have many options.

Attractive Opportunities

- Expansion into Emerging Markets: Many emerging markets have rising middle classes with increasing disposable income and mobile internet access. Investment apps have a significant opportunity to tap into these new user bases by offering localized and accessible investing solutions

- Integration of Advanced Technologies: Incorporating AI, machine learning, and blockchain can offer more personalized investment advice and enhanced security features. These technologies can differentiate apps in a crowded market and improve user satisfaction and retention rates.

- Offering Educational Resources: There is a growing demand for financial literacy. Investment apps that provide comprehensive educational resources can attract new users and build loyalty by empowering users to make informed decisions.

- Social Trading Features: Integrating social trading features that allow users to follow and copy the trades of experienced investors can attract users interested in learning from peers and experts, making investing more accessible and less intimidating for novices.

- Sustainable and Ethical Investing Options: With increasing interest in social responsibility, providing options for sustainable and ethical investing can attract a segment of investors who are looking to make a positive impact with their money. This is especially appealing to younger investors who prioritize values-based investing.

Conclusion

In conclusion, the investment apps market is poised for significant growth, driven by a combination of technological innovations, an increasing appetite for financial literacy and independence, and the widespread adoption of mobile technology. As users continue to seek convenient, reliable, and effective ways to manage and grow their investments, the demand for these apps is likely to soar. Opportunities abound for developers and financial institutions to innovate and expand, particularly in untapped emerging markets. Overall, investment apps are not just redefining personal finance management but are also setting the stage for a more inclusive financial future. This vibrant market dynamic ensures that both users and providers will continue to benefit from the evolving landscape of financial technology.

Source:

- https://financebuzz.com/best-investment-apps

- https://www.investopedia.com/best-stock-trading-apps-4587996

- https://moneywise.com/investing/investing-basics/the-best-investing-apps

- https://www.thepennyhoarder.com/investing/best-investment-apps/

- https://www.thinkwithgoogle.com/consumer-insights/consumer-trends/app-growth-mobile-playbook-search-stock-investment/

- https://learn.g2.com/stock-trading-apps-statistics

- https://www.businessofapps.com/data/stock-trading-app-market/

- https://portfolio-hub.co.uk/blog/169/top-10-investment-apps-for-the-uk-market-in-2023

- https://explodingtopics.com/blog/financial-trends

- https://www.themoneysage.io/blog/top-financial-trends-2023-2024-guide